Today's main points :

- Dollar Index (Continued to rise to 112.224)

- SP500 (About 1.87% off)

- Gold (Facing strong resistance since 1728)

Summary of yesterday's market movement:

On Thursday (October 6) US Dollar Index rose to 112.224 (+1.35%)

Yesterday, market volatility would be relatively low. As the market has begun to consume expectations on US non-farm data and the volatility in gold this week has exceeded the average volatility of $50, the market will be more cautious and wait. US nonfarm payrolls data for today. determine the future direction, indirectly helping the dollar index increase. Gold fell to 1706 (-1.09%) As the US dollar and US bond yields rose, gradually putting pressure on gold. Crude oilUS rose to 89,037 (+2.29%) Based on OPEC+ agreement to reduce oil production by 2 million tons per day and continue to be strongly supportive of crude oil. US Stocks Index closes below, SP500 drops to 3735 (-1.87%) NASDAQ drops to 11440 (-1.94%) Federal Reserve will continue to raise interest rates as markets worry that panel data Nonfarm payrolls will rise again on Friday. Therefore, the market will be more cautious, putting pressure on the stock index in the short term. As cryptocurrencies closely correlate with stock indices, causing Bitcoin to drop to 19855 (-2.82%).

Calendar of important economic data

- CAD Unemployment Rate

- US Non-Farm Employment Change

Based on Canada continuing to raise interest rates significantly and starting to gradually reduce market demand, job demand began to decline. As a result, we expect the Canadian jobs data to be lower than expected, which will weigh on the CAD.

The dollar came under pressure as the US raised interest rates three times in a row to 75 basis points, hinting it will hike rates by 125 basis points in 2022 and prompting market expectations for US jobs data. The period will be lower than expected. But the price has broken out of the average range and could lead to a "buy the rumor, sell the fact" situation today.

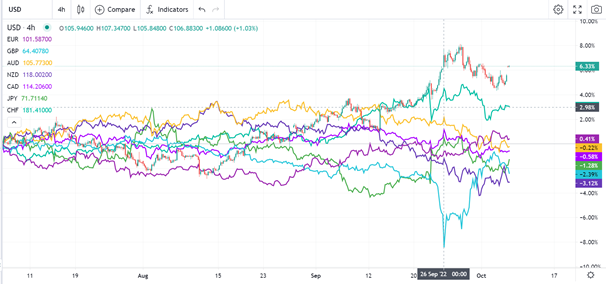

Currency Strength

Based on the Fed raising interest rates by 75 basis points three times in a row and the proposal that it will raise rates by 125 basis points in 2022, it should continue to create a strong uptrend for the dollar. On the contrary, it will also continue to come under pressure on commodity currencies.

From the strength of the currency index, it can be seen that the US dollar remains strong, while the diversity suggests that the euro continues to weaken in the future. Therefore, we can continue to sell EUR/USD, GBP/USD

Trading Opportunities

USDX (Dollar Index)

Since the US Dollar Index has strong resistance at 115.00 and is also in the overbought zone leading to slight downside, the uptrend should continue in the future. When the Fed hints at a further 125 basis points in 2022, it shows strong support for the dollar index.

From a technical analysis perspective, the Dollar Index has reached the overbought zone causing the dollar index to turn back. But following the EMA (Exponential Moving Average) shows strong uptrend momentum. Therefore, we assume that Dollar Index will continue to rise in the future, USD Index will face strong support around 110,500

The Bank of Japan announced that it was halting its coronavirus pandemic relief program and inflation nearing 2.5%, before announcing that it would begin announcing on September 30 the size of its intervention. What would a forex card look like? When forex intervention is implemented, the method of operation is to sell a large number of dollars and buy a large number of yen, which means that the appreciation of the dollar will start to weaken in the short term. Therefore, the yen will appreciate in the near term.

From a technical analysis perspective, the price movement is still in an uptrend. However, the 1-hour EMA (Exponential Moving Average) shows bullish momentum. Therefore, we can try to make about 141,300 . long